Dar Al-Ifta: Permissibility of Banking and Investment Profits

Bank profits are not considered usury and can be spent on personal or charitable purposes under Islamic law.

The Egyptian Dar Al-Ifta confirmed that dealing with banks and earning profits from them is permissible, and spending these funds in lawful ways is Sharia-compliant. Banking activities fall within the framework of legal finance and investment.

The Dar clarified that these profits are not prohibited loan interest (riba), but lawful returns from contracts benefiting all parties involved.

Using Profits for Charity:

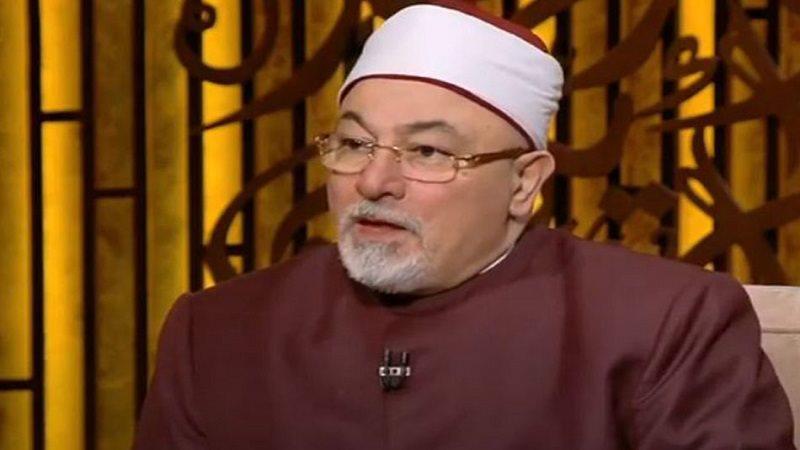

Sheikh Mahmoud Al-Tahan, Secretary of Fatwa at Dar Al-Ifta, addressed inquiries about depositing money in banks for investment and using the returns for charitable causes, such as helping the poor or donating.

Speaking on the program "Fatawa Al-Nas," he emphasized that depositing funds in official banks or regulated financial institutions is permissible, while avoiding fraudulent or unreliable transactions.

He added that investment profits are lawful and can be used for personal needs or charitable works, highlighting that this practice aligns with Islamic law and provides a safe way to support the needy and contribute to public welfare.

أوضح الدكتور محمود شلبي، أمين الفتوى بدار الإفتاء المصرية، أن مساعدة الزملاء بالغش أثناء الامتحان تدخل ضمن التعاون على الإثم، وهو أمر محرم شرعًا.

أمين الفتوى يوضح شروط الزكاة على الإيجار وكيفية احتسابها

الشيخ خالد الجندي يؤكد أن استحضار عظمة الله في القلب يقي من الكبرياء والذنوب ويمنح الطمأنينة ويقضي على القلق والهموم النفسية.

الشيخ خالد الجندي يحذر من أخطر صور الشرك الخفي ويؤكد أن نسب النعم للنفس يورث الغرور، داعيًا المسلمين لشكر الله على كل فضل.