Business Shop Zakat Rules Explained by Egypt’s Dar Al-Ifta

A detailed clarification from Dar Al-Ifta on how to calculate zakat for commercial shops, bank deposits, and the ruling on giving zakat to an unemployed son.

Egypt’s Dar Al-Ifta stated that the purchase price of a commercial shop is not subject to zakat, while zakat is due on the working capital within the shop. This includes evaluating all goods, external receivables, and installment payments owed by customers, deducting outstanding debts owed to suppliers, and paying 2.5% on the remaining amount as commercial zakat.

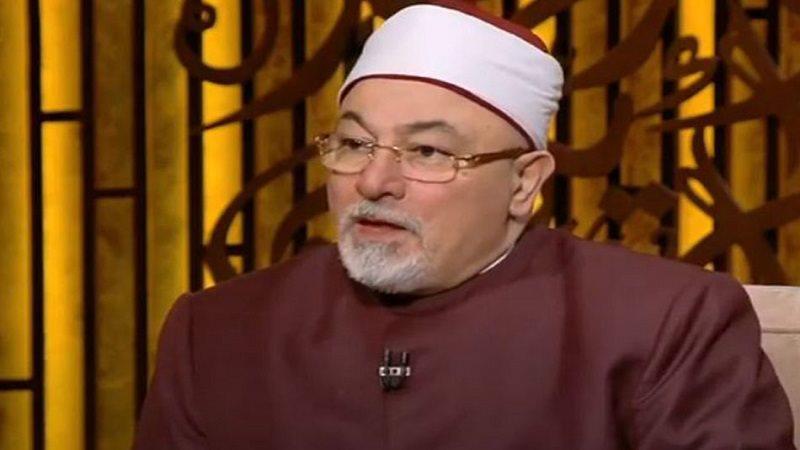

Sheikh Awida Othman explained that the shop’s merchandise, receivables, and liabilities must be calculated accurately, and zakat is paid on the net total after deducting debts.

Regarding money deposited in banks, Dr. Magdy Ashour clarified that zakat is paid at 2.5% on the principal plus profits once the amount reaches nisab and a lunar year passes. However, if the depositor lives mainly on the profits and reducing the principal harms him, he may pay zakat only on the profits at a rate of 10% when received.

On giving zakat to an unemployed son who refuses to work, Dr. Mahmoud Shalaby stated that it is not permissible to give him zakat because he is capable of earning but chooses not to. However, a married and independent son who strives yet struggles financially may receive zakat when needed.

أوضح الدكتور محمود شلبي، أمين الفتوى بدار الإفتاء المصرية، أن مساعدة الزملاء بالغش أثناء الامتحان تدخل ضمن التعاون على الإثم، وهو أمر محرم شرعًا.

أمين الفتوى يوضح شروط الزكاة على الإيجار وكيفية احتسابها

الشيخ خالد الجندي يؤكد أن استحضار عظمة الله في القلب يقي من الكبرياء والذنوب ويمنح الطمأنينة ويقضي على القلق والهموم النفسية.

الشيخ خالد الجندي يحذر من أخطر صور الشرك الخفي ويؤكد أن نسب النعم للنفس يورث الغرور، داعيًا المسلمين لشكر الله على كل فضل.